Beyond the Balance Sheet: Smart Strategies for Financial Success

We go beyond the numbers to provide clarity, strategy, and peace of mind. Whether you're a business owner, investor, or individual looking to optimize your finances, our expert insights help you navigate tax planning, financial reporting, and strategic growth with confidence. Let’s turn complexity into opportunity—one number at a time.

CRA Direct Deposit Information: How to Update Your Details

Keeping your direct deposit information up to date with the Canada Revenue Agency (CRA) is essential for receiving timely payments, including tax refunds and benefits. However, recent changes to CRA’s…

CRA Expands Online Mail Delivery: What Individuals Need to Know

The Canada Revenue Agency (CRA) has significantly expanded its use of online mail, affecting how individuals receive tax-related correspondence. These changes reflect CRA’s broader digital strategy and carry important…

Changing Support Agreements: When Spousal Support Becomes Child Support

When it comes to support payments following a separation or divorce, the distinction between spousal support and child support is…

TFSA Excess Contributions: When Decline in Value Traps Taxpayers

A Federal Court decision on July 25, 2025 upheld CRA’s denial of penalty tax relief for excess TFSA contributions—even when the taxpayer couldn’t…

CRA Transition to Online Mail for Business Accounts

The Canada Revenue Agency (CRA) has introduced a major change in how it communicates with business owners. As of Spring 2025, online mail is now the default method for delivering most correspondence related to…

Voluntary Disclosure Program (VDP): What’s New as of October 1, 2025?

The Voluntary Disclosures Program (VDP) from the Canada Revenue Agency (CRA) offers taxpayers a chance to correct past tax mistakes before CRA identifies them. If accepted, the disclosure can lead to…

CRA Electronic Payment Requirements: What Businesses Need to Know

Since January 1, 2024, any payment over $10,000 to the Receiver General must be made electronically—unless it's not reasonably possible. A $100 penalty can apply for each failure to comply. CRA isn’t enforcing this yet, but that could change quickly. Don’t get caught off guard—switch to electronic payments now and stay ahead of potential penalties.

Dual Wills Explained: What Every CCPC Shareholder Should Know

If you're a shareholder in a Canadian Controlled Private Corporation (CCPC), your estate plan could be costing your beneficiaries unnecessary probate tax. Many business owners don’t realize that a simple legal strategy—having two wills—can protect their corporate assets, reduce tax, and ensure a smoother transition for their business.

Stay Alert: Protect Yourself and Your Business from CRA-Related Scams

Scammers are getting smarter—and their messages look more convincing than ever. From fake tax refunds to fraudulent CRA account alerts, Canadians are being targeted with sophisticated schemes designed to steal personal and financial information. Learn how to spot the latest scams and protect yourself and your business before it’s too late.

Understanding TFSA Contribution Limits: Why You Should Always Double-Check Before Depositing

Before you make that next deposit, make sure you're not relying on outdated CRA figures. Many Canadians unintentionally overcontribute—and face steep penalties—because they misunderstand how TFSA limits are reported. Learn how to protect yourself and your savings in our latest blog post.

Canada Disability Benefit: New Support for Canadians with Disabilities

The Canada Disability Benefit is a new federal monthly payment launching in July 2025, aimed at supporting working-age individuals with disabilities who have low income, to reduce…

Service Payments and the CRA: What Most Small Businesses Are Missing

Many small businesses are overlooking a CRA requirement that could lead to compliance issues — and it all comes down to how you report payments for services. The CRA recently surveyed businesses across Canada, and the results might surprise you.

Missing Investment Slips? Why CRA’s 2024 Tax Season Caught Canadians Off Guard

Filed your taxes but something feels off? Thousands of Canadians discovered missing investment slips during the 2024 tax season—thanks to a quiet change at the CRA that disrupted the usual process. Find out what caused the delay…

Flipping or Investing? What a 2024 Court Case Reveals About Real Estate Taxation in Canada

A recent Court of Quebec decision highlights how quickly a real estate sale can shift from a capital gain to fully taxable income—depending on your intent, actions, and history. If you're buying, renovating, and selling property, here's what you need to know before your next transaction..

Turning Vacation Rentals into a Business: What a Recent Tax Court Case Reveals

When does a short-term rental operation qualify as a legitimate business in the eyes of the CRA? A recent Tax Court of Canada decision highlights what it takes to demonstrate commercial intent and secure tax relief for short-term rental activities...

Resigned But Still Responsible? The Hidden Liability of De Facto Directors

Think you're off the hook after resigning as a corporate director? Think again…

Don’t Let a Fake Email Compromise Your Data—Stay Ahead of Phishing Threats

AI is changing the face of cybercrime—here’s what you need to know…

SLAM THE SCAM: Protect yourself against Fraud

Most, if not all of us, have received a call from someone claiming to be from CRA. They may threaten arrest or other such actions if a tax bill is …

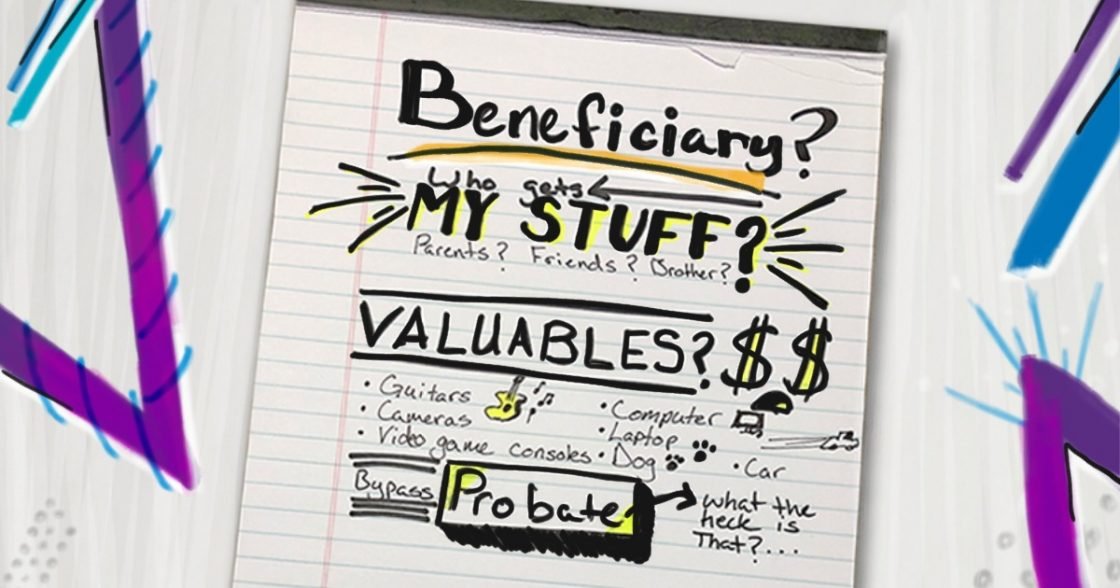

WILL AND BENEFICIARY DESIGNATIONS: Are they current?

RRSP Designations A May 10, 2021 CBC article demonstrated the importance of reviewing RRSP beneficiary designations. The article discussed the unfortunate cascade of events where, in 2018, a 50-year-old individual …

RENTAL PROPERTIES: Major Repair Expenses

In a February 11, 2021 Tax Court of Canada case, the deductibility of rental expenses for a condo unit that underwent major repairs was considered. In 2010, major structural repairs …